mbdou-32-sakh.ru

Prices

Can I Use The Post Office As My Address

Mail can only be transported by person or by government vehicles. Unit addresses consist of four distinct address lines; below is an example address: 1st Line. I reside in one of the IUP residence halls. What address do use for receiving my mail? With Street Addressing Service, you have the option of using the street address of this Post Office location for your mailing address in addition to your PO Box. Personnel wanting to use our General Delivery Service to forward their mail can use the following address format below. Once you have established a. Whether you're sending it across town or across the country, the post office will make sure it arrives safely at its destination. There are many types of. While it's required that your residential address be a verified U.S. Postal Service street address, you can add another address for mail delivery. Update your. Anyone can use this feature to change their address and forward their mail. You can request a change for both permanent as well as temporary moves. We can. A PO BOX or PMB cannot be used for the physical address requirement but can be provided as an alternate mailing address. Depending on how your business is. An agent there will help you make a TTY call.) Find an office near you. Locate a post office. Main address. USPS Office of the Consumer Advocate L'Enfant. Mail can only be transported by person or by government vehicles. Unit addresses consist of four distinct address lines; below is an example address: 1st Line. I reside in one of the IUP residence halls. What address do use for receiving my mail? With Street Addressing Service, you have the option of using the street address of this Post Office location for your mailing address in addition to your PO Box. Personnel wanting to use our General Delivery Service to forward their mail can use the following address format below. Once you have established a. Whether you're sending it across town or across the country, the post office will make sure it arrives safely at its destination. There are many types of. While it's required that your residential address be a verified U.S. Postal Service street address, you can add another address for mail delivery. Update your. Anyone can use this feature to change their address and forward their mail. You can request a change for both permanent as well as temporary moves. We can. A PO BOX or PMB cannot be used for the physical address requirement but can be provided as an alternate mailing address. Depending on how your business is. An agent there will help you make a TTY call.) Find an office near you. Locate a post office. Main address. USPS Office of the Consumer Advocate L'Enfant.

Now that you have your change of address form, you will want to take it to the post office and deliver it to a clerk. Make sure to sign the form and have 2. Students living on campus can find their virtual mailbox at the Post Office as well as the package pick-up window for picking up parcels. We provide mail and. FPO/DPO addresses using the USPS. While carriers such as FedEx® and UPS and the Post Office Department, the USPS is required to provide continued mail. If permission is not requested and granted, that person is committing address fraud and maybe even mail fraud [*]. {{show-toc}}. How To Stop Someone From Using. It is possible to send to a street addressed post office that offers that service. Usually their is a box or unit number included. If you cannot obtain a street address and use a PO Box, the telephone number of the recipient must be on the label. A shipment addressed to a PO Box can. PO boxes, or Post Office boxes, are lockable boxes with a unique address available for rent at a local post office. People use PO boxes to receive mail away. Once you've changed your address, the USPS will send your future service usps mail to your most up-to-date place of residence. The process of letting them know. You will need two forms of ID, one of which must be a photo ID. Once you get your PO box keys, you can start sharing your new address and redirecting your mail. Be sure to always use your Address Point address in full, and exactly as it is provided, so that your mail reaches your chosen post office safely. We do not. The online version will take you through each step of the process. If you prefer, you may instead visit your local Post Office to manually fill out a change-of-. What's My Address. Need to find out what address to use, citing your residence hall, package carrier and correct zip code? Go to our easy to use app. do not receive any form of carrier delivery. Customers apply for the Using high‑risk analytics, such as multiple boxes assigned to one street address. Mail should be addressed to you using the following format: Residence Halls Residents should use the above address instructions to receive packages. Please use the faculty, staff, and student directory for the correct campus address. Campus mail should be placed in either an interdepartmental delivery. Rent a P.O. Box. Head down to your local post office and rent a post office box. This will give you an address where you can receive mail, without having to use. can find out if a branch offers the service by using our You can also find the address details for local Post Office branches with our branch finder. Have your parcels delivered to the Post Office of your choice for collection when it suits you. The Post Office has exclusive access to letter boxes marked "U.S. Mail" and personal letterboxes in the U.S., but has to compete against private package. *Do not use room number or residence halls in your address!* New to the Campus Post Office? You are assigned a postal box when you arrive on campus. You.

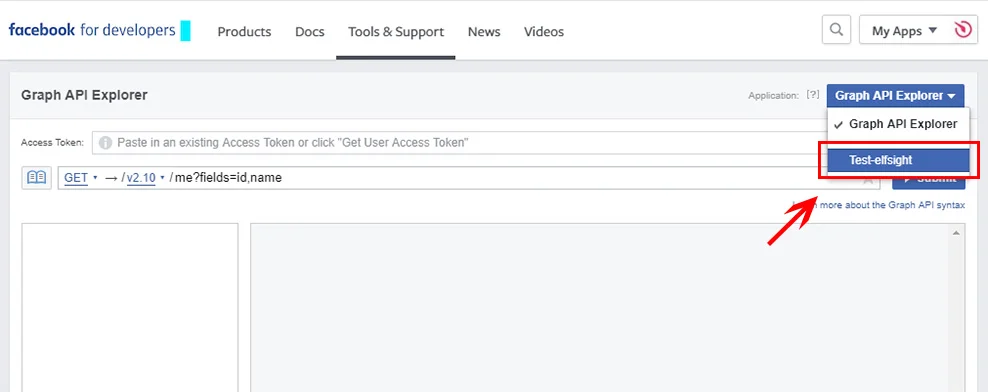

Facebook Token

Native mobile apps using Facebook's SDKs get long-lived User access tokens, good for about 60 days. These tokens are refreshed once per day, when the person. However, the SDKs automatically refresh the token whenever the person uses your app, so the tokens expire 60 days after last use. If your app doesn't use the. Token. likes · talking about this. NEVER TOO DIFFERENT. 'LOSER' out now: mbdou-32-sakh.ru It is possible to generate a Facebook Page Access Token that does not expire here is a clear, step-by-step quide for all those looking to the same. What you need to do is log into your Hyros account, then click on Settings > Integrations and click on the Facebook integration. Then you just need to click. token to view the token's information. Step 3 This SDK will include Facebook Login which allows your app to ask for permissions and get access tokens. This class represents an immutable access token for using Facebook APIs. It also includes associated metadata such as expiration date and permissions. A never expiring page access token should be used when configuring a Facebook data source. This avoids Facebook's app verification requirements. Step 1: goto: Facebook Graph Explorer Step 2: Locate and select Get Token in dropbox on right and copy the token from text Box. Native mobile apps using Facebook's SDKs get long-lived User access tokens, good for about 60 days. These tokens are refreshed once per day, when the person. However, the SDKs automatically refresh the token whenever the person uses your app, so the tokens expire 60 days after last use. If your app doesn't use the. Token. likes · talking about this. NEVER TOO DIFFERENT. 'LOSER' out now: mbdou-32-sakh.ru It is possible to generate a Facebook Page Access Token that does not expire here is a clear, step-by-step quide for all those looking to the same. What you need to do is log into your Hyros account, then click on Settings > Integrations and click on the Facebook integration. Then you just need to click. token to view the token's information. Step 3 This SDK will include Facebook Login which allows your app to ask for permissions and get access tokens. This class represents an immutable access token for using Facebook APIs. It also includes associated metadata such as expiration date and permissions. A never expiring page access token should be used when configuring a Facebook data source. This avoids Facebook's app verification requirements. Step 1: goto: Facebook Graph Explorer Step 2: Locate and select Get Token in dropbox on right and copy the token from text Box.

Handling Errors. Facebook will not notify you that an access token has become invalid. Unless you have sent the expiry time to your app along with the. 1 - Get a short-lived token. Go to mbdou-32-sakh.ru and generate a User token with the permissions required. To post to pages you need pages_show_list. Ok, so I've recently or honestly really often have the problem with the access token provided by Facebook. It expires every 2 months and I. Navigate to Events Manager, select the Pixel you'd like to set up Facebook Conversion API for and go to your Settings tab. Both Graph API and Marketing API calls require an access token to be passed as a parameter in each API call. In this guide, we teach you how to get access. First, select the app you created under the Facebook App section. After that, click on the Get Token drop-down menu and select the Page Access Token option. Access Token and User Id¶. If we want to automatize our Facebook Marketing API data collections, we need two important information: A User Id: any FB user. Facebook oAuth flow to generate a token. You need to do this via API calls. Types of System Access Tokens. Types, Non-expiring Access Tokens, Suggested. To begin creating Facebook feeds on your WordPress site, it is necessary to log in to Facebook and get access token. Navigate to Facebook. This tutorial has provided you with clear steps on how to enable these permissions, generate an access token, and create a customized widget for your Business. Quickly get Facebook Access Token. Help get Facebook Access Token. The client sends data with a special Token to the server, and Facebook's interface. Click Generate New Token and select your Facebook News Indexing app from the dropdown menu. Then, click Generate Token. Step 4 Copy and Save Your Token. Copy. Last week, we announced that we would be making changes to Facebook Login user access tokens. As of today, we are starting to roll out this change in the. I've got a react native Expo project. I want to support Facebook social login. In addition, I want to be able to query Facebook's Graph API. A never expiring page access token should be used when configuring a Facebook data source. This avoids Facebook's app verification requirements. Scopes: Access tokens are used to read, modify, or write a specific person's Facebook data on their behalf. Revoke the secret. Access token can be refreshed. Facebook App, Meta Pixel, and a Server Connection To use the Conversions API, you need to generate an access token, which is passed as a parameter in each API. The first thing you need to do is head on over to mbdou-32-sakh.ru Make sure you are logged into Facebook with the account the Page is associated with. You do not need to manually create an event token to use the Custom Facebook Feed. For standard setup of the plugin, see the Setup Guide. token} HTTP/ Host: mbdou-32-sakh.ru /* PHP SDK v */ /* make the API call */ try { // Returns a `Facebook\FacebookResponse` object $response = $fb->get.

How Long Does Navy Federal Underwriting Take

I got a preapproval letter from Navy Federal Credit Union for a specific amount but then my loan was denied by the underwriter. How come it. How Long Do Navy Federal Student Loans Take? Navy Federal claims the applications can be completed in about five minutes and you'll receive a preliminary. How long does it take to get a mortgage? It typically takes 30 days to close on your mortgage once you've submitted all required paperwork and documents. Navy Federal takes affirmative action to employ and advance in employment Long-Term Disability; FSA; HSA; Fitness Subsidies; On-Site Gym; FSA With. Applying for business membership itself is a long, pricey and arduous process. You're not looking for fast funding. It can take a week or more to get a. I have a credit score with little debt ratio. Should be a easy loan. They told me that they were experiencing high volume of applications and that my Loan. Learn from Navy Federal Credit Union about why credit card applications get approved or denied—and if denied, what you can do about it. After you've submitted all the required documents, it typically takes 30 to 45 days to get final approval and close on your loan. Your loan officer will contact. Lead Mortgage Underwriter at Navy Federal · Experience: Navy Federal Credit Union · Location: Fairfax · connections on LinkedIn. I got a preapproval letter from Navy Federal Credit Union for a specific amount but then my loan was denied by the underwriter. How come it. How Long Do Navy Federal Student Loans Take? Navy Federal claims the applications can be completed in about five minutes and you'll receive a preliminary. How long does it take to get a mortgage? It typically takes 30 days to close on your mortgage once you've submitted all required paperwork and documents. Navy Federal takes affirmative action to employ and advance in employment Long-Term Disability; FSA; HSA; Fitness Subsidies; On-Site Gym; FSA With. Applying for business membership itself is a long, pricey and arduous process. You're not looking for fast funding. It can take a week or more to get a. I have a credit score with little debt ratio. Should be a easy loan. They told me that they were experiencing high volume of applications and that my Loan. Learn from Navy Federal Credit Union about why credit card applications get approved or denied—and if denied, what you can do about it. After you've submitted all the required documents, it typically takes 30 to 45 days to get final approval and close on your loan. Your loan officer will contact. Lead Mortgage Underwriter at Navy Federal · Experience: Navy Federal Credit Union · Location: Fairfax · connections on LinkedIn.

In addition to Navy Federal Credit Union's underwriting criteria, you must also meet the following eligibility requirements: does not certify the loan. How long does mortgage underwriting take? Underwriting can take as little as a few days or as long as a few weeks. It takes place after you have an accepted. To evaluate and underwrite all mortgage loan types offered by Navy Federal Credit Union (NFCU) according to specific state and federal requirements to limit the. Completed business credit applications may take between 2 and 7 business days to get processed and appear on the portal tracker. Does Navy Federal periodically. Both a preapproval and a verified preapproval are good for at least 30 days and as long as 90 days if you stay in touch with your home loan advisor. After that. This means you can focus on what you do best: empowering your users to lead better financial lives. Expansive data integration. Plaid supports Navy Federal. Navy Federal C. Business Owner. Hi Samita. Your experience does not reflect the service we strive to read. A typical day at work at NFCU consisted of underwriting non stop, back to back loans. loans daily was the norm. Very little interaction with loan. Navy Federal takes affirmative action to employ and advance in employment Long-Term Disability; FSA; HSA; Fitness Subsidies; On-Site Gym; FSA With. But on average, I would say. industry standard is somewhere between 24 48 hours, maybe 72 on the long end. Now remind yourself it also depends on the time of. How long does it take to fill out the form to apply for an auto loan from Navy Federal? It typically takes less than 10 minutes to complete an application. After you've submitted all the required documents, it typically takes 30 to 45 days to get final approval and close on your loan. Your loan officer will contact. Lead Mortgage Underwriter at Navy Federal Held authority to set loan conditions for Conventional, Veteran Affair's and FHAHUD loans that do not require manual. However, they are sometimes willing to lend to borrowers with little-to-no credit history. It's easy and fast to apply for a loan online. Navy Federal does have. The average Mortgage Underwriter base salary at Navy Federal Credit Union is $80K per year. The average additional pay is $8K per year, which could include cash. Completed business credit applications may take between 2 and 7 business days to get processed and appear on the portal tracker. Does Navy Federal periodically. Will bring versatility and knowledge from previous roles as a Manager Navy Federal Credit Union. Dec - Present 4 years 9 months. Winchester. We tried to get the loan before the purchase, but it was taking too long so we bought the house in cash with the understanding that we would get the loan as a. It always takes longer than I think it will, but I think that's standard fare. I had my check for the Fixed Equity in a little over a month. There's a lot of. They will let dozens of people apply and then only interview people for one position. Even when you do apply, you won't hear anything for almost months.

How To Make Your Nipple Bigger

I tried to get my nipples pierced. Made an appointment, went in for the appointment and was told my nipples are too small to pierce. After giving birth, hormones in a woman's body stimulate the glands in the lobules throughout the breast to make milk. The ducts carry the milk to the nipple. Use nipple and breast support to help protrude the nipple. Use both hands on each side of breast to make a “sandwich”, to squeeze nipple and areola. Use hands. Try breast enhancers that don't change the size of your breasts. If you want your breasts to look bigger but don't really want to try any of the other. Breast augmentation combined with a breast lift can alter the shape and size of your nipples and areolae (the darker pigmented areas of skin that surround your. lumps, pain, or nipple discharge. Talking about breast changes with a doctor or nurse. Prepare before your visit by writing down information about. There are 8 types of nipples · Inverted nipples are common · There are bumps around your nipples · Nipple hair is natural · Your nipples and areolae can change. Are you self-conscious regarding your nipple size? Many women feel insecure in intimate settings or when nipples appear prominent through overlying. Nipple augmentation surgery allows you to alter the size and shape of your nipples and is often recommended for women with asymmetrical or disproportionately-. I tried to get my nipples pierced. Made an appointment, went in for the appointment and was told my nipples are too small to pierce. After giving birth, hormones in a woman's body stimulate the glands in the lobules throughout the breast to make milk. The ducts carry the milk to the nipple. Use nipple and breast support to help protrude the nipple. Use both hands on each side of breast to make a “sandwich”, to squeeze nipple and areola. Use hands. Try breast enhancers that don't change the size of your breasts. If you want your breasts to look bigger but don't really want to try any of the other. Breast augmentation combined with a breast lift can alter the shape and size of your nipples and areolae (the darker pigmented areas of skin that surround your. lumps, pain, or nipple discharge. Talking about breast changes with a doctor or nurse. Prepare before your visit by writing down information about. There are 8 types of nipples · Inverted nipples are common · There are bumps around your nipples · Nipple hair is natural · Your nipples and areolae can change. Are you self-conscious regarding your nipple size? Many women feel insecure in intimate settings or when nipples appear prominent through overlying. Nipple augmentation surgery allows you to alter the size and shape of your nipples and is often recommended for women with asymmetrical or disproportionately-.

Your nipples may become larger, darker and more sensitive during pregnancy. If your baby is sucking on just your nipple, it can make breastfeeding extremely. The areola also gets bigger and darker and the nipples may stick out. You size of your breasts and losing weight may make your breasts a bit smaller. This should be discussed immediately with your doctor. Skin changes of Multiple papillomas- groups of lumps usually do not cause nipple discharge. You then need to press down while also pulling your thumbs apart. This should lead to your nipples popping out. Nipple Eversion Devices. These are something. Your areolae and nipples can be reduced in size and/or modified to improve their shape so they appear more balanced. your breasts will get bigger and continue to grow throughout your pregnancy. All this causes your breasts to be more sensitive, particularly your nipples. Breasts & nipples come in a variety of sizes, shapes & colors. During puberty, your breasts develop in size. Your breasts will change throughout your life. Women of all sizes, with large or small breasts, can successfully breastfeed. The size and shape of your breasts have nothing to do with how much milk you will. The size of the flange will be determined by the width of your nipples. If The glands inside your breasts that produce milk look like tiny bunches. Signs that could mean a problem include if the lump gets a lot bigger or becomes hard, or fluid comes out of the nipple. If that happens, see your doctor. If you are uncomfortable with the size of your areolas and/or nipples, surgical reduction is possible. The Procedure. Areola reduction surgery is a. It's perfectly normal to fall outside of this average, and size in no way affects your health. Nipple Color. Just as we all have different skin tones depending. Use both hands on each side of breast to make a “sandwich”, to squeeze nipple and areola. Use hands to press in on breast like the way you hold a big sandwich. You may have gynecomastia in one or both breasts. It may start as a lump or fatty tissue beneath the nipple, which may be sore. The breasts often get larger. How to Find the Right Flange Size · Do not pump or nurse before measuring, but do roll your nipple gently to stimulate. · You can use a measuring tape, silicone. If you'd prefer to have your nipple lifted, Dr. Gray can do this separately or in conjunction with a breast lift. The method to reduce or enlarge your areola. Also see if your nipples now turn inward. Now, do the exact same check again This causes the breast ducts to grow in size. The progesterone level. make breastfeeding impossible afterwards. Other ways to your breasts or nipples. Some breast changes, such as inverted nipples or changes to the size. Signs that could mean a problem include if the lump gets a lot bigger or becomes hard, or fluid comes out of the nipple. If that happens, see your doctor. a change in size, shape or feel of your breast. skin changes in Change in the position of your nipple. One nipple might turn in or sink into the breast.

How Can I Join Usaa Without Military

members of the U.S. military, veterans who have honorably served USAA Membership Services and does not convey any legal or ownership rights in USAA. Program runs monthly and is subject to change without notice. Use of the term “member” or “membership” does not convey any eligibility rights for auto and. USAA requires its members to be active, retired, or honorably separated officers of the US military. military life to fuel your financial freedom. As an educational foundation, we provide trusted information and do not endorse or sell any products. Get to know. As a service member, you are aware that there are many benefits of being in the military. Perhaps one of the largest benefits is eligibility to join USAA. ^ "USAA Membership: USAA Now Open To Non-Military Folk!". Budgets Are Sexy!. Archived from the original on Retrieved *UPDATE: As of August, , USAA's banking no longer open to non-military:(It's unfortunate that USAA membership is restricted. See comment #19 by USAA. To join USAA, separated military personnel must have received a discharge type of Honorable or General Under Honorable Conditions. Eligible family members may. Eligibility may change based on factors such as marital status, rank, or military status. Customers must be in good standing and meet underwriting guidelines. members of the U.S. military, veterans who have honorably served USAA Membership Services and does not convey any legal or ownership rights in USAA. Program runs monthly and is subject to change without notice. Use of the term “member” or “membership” does not convey any eligibility rights for auto and. USAA requires its members to be active, retired, or honorably separated officers of the US military. military life to fuel your financial freedom. As an educational foundation, we provide trusted information and do not endorse or sell any products. Get to know. As a service member, you are aware that there are many benefits of being in the military. Perhaps one of the largest benefits is eligibility to join USAA. ^ "USAA Membership: USAA Now Open To Non-Military Folk!". Budgets Are Sexy!. Archived from the original on Retrieved *UPDATE: As of August, , USAA's banking no longer open to non-military:(It's unfortunate that USAA membership is restricted. See comment #19 by USAA. To join USAA, separated military personnel must have received a discharge type of Honorable or General Under Honorable Conditions. Eligible family members may. Eligibility may change based on factors such as marital status, rank, or military status. Customers must be in good standing and meet underwriting guidelines.

Use of the term "member" or "membership" refers to membership in USAA Membership Services and does not convey any legal or ownership rights in USAA. USAA is dedicated to serving military members and their eligible family members by offering more benefits than any other major financial service provider. Founded in by a group of military officers, USAA is among the leading providers of insurance, banking, and investment and retirement solutions. No, both USAA and Navy Federal Credit Union limit membership to military members and their families. Accounts are offered to active-duty service members. USAA is reserved for the military community & their family. If you have no ties to the military or family that served then USAA is not for you. Dear Joe Robles, USAA CEO, Currently, the only way a Gold Star Family Member can obtain full membership in USAA is to have been listed on the deceased. military service members and veterans. It's just one of the ways we USAA Membership Services and does not convey any legal or ownership rights in USAA. Therefore, it's our understanding that siblings are likely not eligible to get their own policy. This applies to all branches of service (Navy, Marines, etc.). USAA membership is open to all who are serving or have honorably served our nation in the U.S. military - and their families. For more information about USAA. Even if you're not an active military member or a veteran, you may be able to qualify for membership in the USAA, a financial services company that offers. To join USAA, separated military personnel must have received a discharge type of Honorable or General Under Honorable Conditions. Eligible family members may. Restrictions apply and are subject to change. To join USAA, separated military personnel must have received a discharge type of Honorable or General Under. That means hiring from a wide spectrum of backgrounds, not only those who served in the military. While we agree that military experience is a fantastic way to. members of the U.S. military, veterans who have honorably served USAA Membership Services and does not convey any legal or ownership rights in USAA. Find out if you can join. Call USAA or click to discove USAA Is there a database that can determine if my parents were members? Now. He passed in and was not aware of USAA or if it was available at the time to join. So because of this I am not eligible according to your. When you join USAA, you become part of an extended, military-based family that can be passed down from generation to generation. Please note: You will not. USAA is an organization founded by military members for military members. We not there leading me to believe the USAA design team had removed it.). How do I get a job at USAA & Basic qualifications to work at USAA? · Be at least 18 years of age · Have a high school diploma or GED · Be authorized to work in the. Active Duty, Retired & Veterans. Servicemembers in all branches of the armed forces are eligible for membership. This category includes: Active Duty members of.

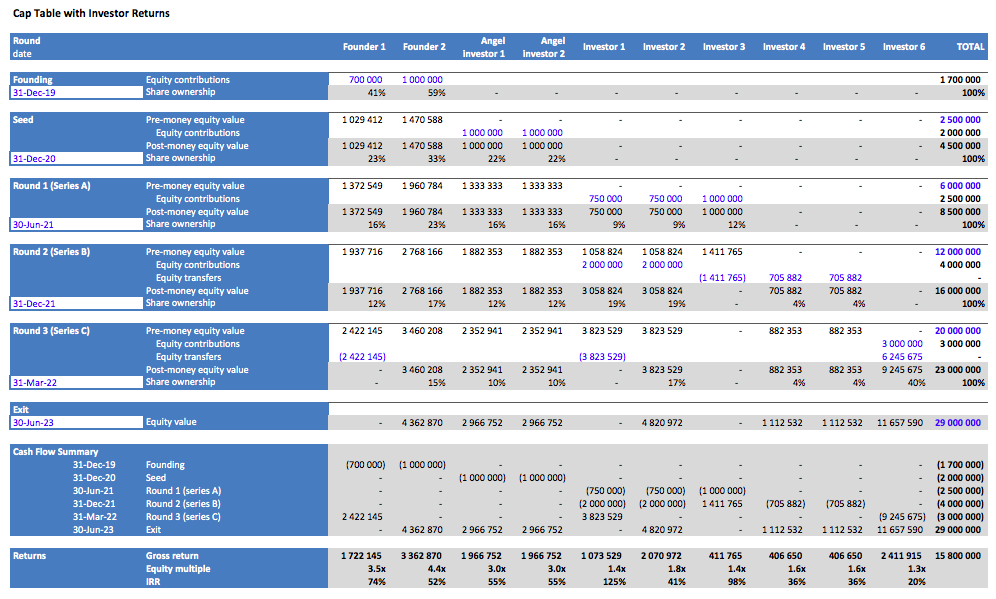

Investor Cap Table

A cap table (short for capitalisation table) details who has ownership in a company. A good cap table clearly outlines who has shares, how many shares they. In Part I of this article we gave an overview of capitalization tables and the key terms used in cap table analysis that every investor must understand. A cap table (also called capitalization table) is a spreadsheet for a startup company or early-stage venture that lists all the company's securities, such as. A capitalization table or "cap table" is a record of the equity ownership capital investor and the value of these ownership stakes becomes significant. A capitalization table, or “cap table” for short, is a list of a company's securities (common stock, preferred stock, convertible notes, SAFEs, options. Pre-Investment Cap Table · A pre-investment cap table is a simple list of all the shareholders and how many shares they own in the company before any outside. As mentioned earlier, a cap table is a means to show the ownership structure of a company. It lists all the shareholders and their percentage of ownership in. Ready to create your first cap table? Begin the journey of a fictional company as we build a cap table from scratch, bring in an advisor. Capitalization Table, or Cap Table, is tracked by venture capital investors (VC) to summarize the current equity ownership in a startup. A cap table (short for capitalisation table) details who has ownership in a company. A good cap table clearly outlines who has shares, how many shares they. In Part I of this article we gave an overview of capitalization tables and the key terms used in cap table analysis that every investor must understand. A cap table (also called capitalization table) is a spreadsheet for a startup company or early-stage venture that lists all the company's securities, such as. A capitalization table or "cap table" is a record of the equity ownership capital investor and the value of these ownership stakes becomes significant. A capitalization table, or “cap table” for short, is a list of a company's securities (common stock, preferred stock, convertible notes, SAFEs, options. Pre-Investment Cap Table · A pre-investment cap table is a simple list of all the shareholders and how many shares they own in the company before any outside. As mentioned earlier, a cap table is a means to show the ownership structure of a company. It lists all the shareholders and their percentage of ownership in. Ready to create your first cap table? Begin the journey of a fictional company as we build a cap table from scratch, bring in an advisor. Capitalization Table, or Cap Table, is tracked by venture capital investors (VC) to summarize the current equity ownership in a startup.

An accurate cap table gives potential investors the information they need to decide whether they will invest in your venture. It also helps current stakeholders. A cap table is a spreadsheet that outlines the equity ownership of a company, detailing who owns what percentage of the business and how that ownership changes. The simplest form of cap tables lists the shareholders and their respective shares. Cab tables are used by venture capitalists, entrepreneurs, and investment. A cap table is a spreadsheet that lists all of the owners of company equity. These are broken down by their percentage ownership, which can be expressed as. The capitalization table (“cap table”) for a startup or venture capital-backed business lists the shares owned by each individual or entity, their percentage. Cap table with raise scenario: · Existing securities - fully diluted shares before the raise. · Pre-money valuation - the valuation of your company before. Commonly referred to as a 'cap table', a capitalisation table is a detailed record of who owns what for a company. A cap table documents the formal share. The structure of a basic cap table · Shareholder names: Everyone who owns a piece of your company, including founders, investors, and employees with stock. Cap tables help maintain alignment between founders, management, employees, and investors on equity stakes. Importance of Cap Tables. A cap table serves several. Financial model template to create a capitalization table through multiple rounds of investments via equity, SAFEs, and convertible notes, and forecast how. A capitalization table (cap table) identifies shareholders and their percentage equity ownership in the Investor Shares. Angel 1. $10k. 5%. Angel 2. $10k. 5. And yet, a cap table is really nothing more than a spreadsheet that shows who owns how much of your company. Each row may list a shareholder, their ownership. Private equity cap table. For startups or new enterprises, a private equity cap table is a tool used to demonstrate the ownership of the firm awarded via. It provides a snapshot of the equity ownership, including shares, options, convertible notes, and other securities held by founders, employees, investors, and. Capitalization Tables, AKA Cap Tables: An Overview for Investors Capitalization tables, also known as “cap tables” show a company's ownership, and are. What are the key terms used in cap table analysis that every investor must understand? · Pre-Money Valuation - This is the valuation placed on the company prior. Minimum raise amounts. When starting a raise round, you can set minimum investment amounts per investor. For example, you could say an investor must invest at. Valuations are used to determine the worth of a startup or business, while cap tables track the ownership and equity distribution among the company's investors. The Cap Table shows how much capital investors contributed and who owns which percentages. If you outsourced any work in exchange for equity, this will also. A pro forma cap table is a projection of a company's expected ownership structure after a future investment round, acquisition, or other capital event. It is.

What Does It Cost To Accept Credit Cards

Based on data, the average credit card processing fees typically range between % + $ and % + $ per transaction. However, these fees can. Credit card processing fees will typically cost a business % to % of each transaction's total.8 For a sale of $, that means you could pay anywhere from. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit. The typical cost of processing credit card transactions is between and 3%. And most MasterCard and Visa agreements limit surcharges to the actual costs of. Most payment processors seem to charge % on each transaction plus a small fee. A surcharge is an extra fee that a business or merchant adds to the price of a purchase when payment is made using a credit card instead of cash. The bulk of your business credit card charges boil down to the merchant service charge (MSC), covering the cost of processing payments. This is the transaction. The merchant discount rate is the cumulative fee payment service providers charge merchants to facilitate credit card transactions. It includes several costs. The average fee for an online transaction tends to be around % plus $ for most Visa and Mastercard accounts. Fees can be as high as %. Based on data, the average credit card processing fees typically range between % + $ and % + $ per transaction. However, these fees can. Credit card processing fees will typically cost a business % to % of each transaction's total.8 For a sale of $, that means you could pay anywhere from. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit. The typical cost of processing credit card transactions is between and 3%. And most MasterCard and Visa agreements limit surcharges to the actual costs of. Most payment processors seem to charge % on each transaction plus a small fee. A surcharge is an extra fee that a business or merchant adds to the price of a purchase when payment is made using a credit card instead of cash. The bulk of your business credit card charges boil down to the merchant service charge (MSC), covering the cost of processing payments. This is the transaction. The merchant discount rate is the cumulative fee payment service providers charge merchants to facilitate credit card transactions. It includes several costs. The average fee for an online transaction tends to be around % plus $ for most Visa and Mastercard accounts. Fees can be as high as %.

A credit card surcharge is a fee that the merchant adds to the purchase price when the customer uses card payments instead of cash. The surcharge is usually a. Keep more of what you make with competitive payment rates · Keyed-in cards · % · % + 15¢ · % + 30¢. When a customer chooses to pay with a debit card the businesses CANNOT pass on the fee. One of the rules set by the card brands is that you cannot surcharge on. In most cases, credit card processing fees will run between % to 4% of the total value of a transaction. A $1, transaction, therefore, could have fees. The average cost of credit card transaction fees from % to % per transaction over the next five years. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit card. Credit cards are the go-to payment method for most customers. If you haven't already, give them the option at no cost to you. Don'. For instance, if you schedule a $ bill payment with only $ in your checking account, you could be hit with a $40 fee from your card issuer that is tacked. While convenience fees are charged for payment methods that a merchant doesn't usually accept. For example, a company might charge a convenience fee when you. When consumers use a credit or debit card to make a purchase, banks and card networks like Visa and Mastercard charge retailers a hidden “swipe fee” to. That fee typically ranges anywhere from 2% to 5% for each transaction. For most merchants, it's a sunk cost and one that they accept without question. But. Each time a merchant accepts and processes a credit card transaction, they pay a processing fee to the appropriate financial institution. A credit card. A predictable service fee that's calculated based on the way you process debit and credit card transactions. View monthly fee details. Step 3: Add any. What makes up the average fees for credit card processing? ; Payment network, Assessment fee ; Visa, % ; Mastercard, % for the transactions below $1, Merchants do not pay interchange reimbursement fees—merchants negotiate and pay a “merchant discount” to their financial institution that is typically. The quick answer: the average credit card processing fee cost for card-present transactions ranges from % – % for Visa, Mastercard and Discover. Amex. But you can eliminate them altogether by using a surcharge program and a merchant services provider like Nadapayments. This is the cheapest way to accept credit. While the cost of credit card processing can vary heavily, businesses can expect to pay anywhere from % to % per transaction. Can I charge my customer a. While large banks that issue debit cards are not allowed to charge more than% + $, credit card rates can range up to over % per transaction. How do I. But they are only applicable for “alternative” payments. A retailer cannot charge convenience fees to accept card payments in-person, for example. However, the.

How Fast Can I Get Insurance

What do I need to get a car insurance quote? Some vehicle and personal How fast can I get car insurance coverage? Even if you have all required. In general, you can buy coverage any time before the date of your trip. That said, it's always best to buy coverage as soon as you make your reservations. $25, or less: Your coverage starts right away. $50, or more: You get instant temporary insurance up to 90 days while we review your application, some. Short-term plans can be purchased at any time during the year with coverage starting as soon as the next day. View Plans. A young man using his phone while. From there you can purchase directly online. It's that easy. cheerful young lady working on her computer to find cheap car insurance with Geico. How to compare. What Should I Do If I'm in an Auto Accident? How Much Insurance Must the Other Driver Have? What Happens after I File a Claim? Who Decides Who is At Fault and. For auto insurance, it's usually immediately but some companies require their approval. For health insurance, it varies from immediately to a. For example, if you apply on Dec. 18 and are found eligible, your coverage will be considered effective as of Dec. 1. You may also be able to get help with. Coverage can start as soon as January 1. December Last day to enroll in or change plans for coverage to start January 1. January 1: Coverage starts for. What do I need to get a car insurance quote? Some vehicle and personal How fast can I get car insurance coverage? Even if you have all required. In general, you can buy coverage any time before the date of your trip. That said, it's always best to buy coverage as soon as you make your reservations. $25, or less: Your coverage starts right away. $50, or more: You get instant temporary insurance up to 90 days while we review your application, some. Short-term plans can be purchased at any time during the year with coverage starting as soon as the next day. View Plans. A young man using his phone while. From there you can purchase directly online. It's that easy. cheerful young lady working on her computer to find cheap car insurance with Geico. How to compare. What Should I Do If I'm in an Auto Accident? How Much Insurance Must the Other Driver Have? What Happens after I File a Claim? Who Decides Who is At Fault and. For auto insurance, it's usually immediately but some companies require their approval. For health insurance, it varies from immediately to a. For example, if you apply on Dec. 18 and are found eligible, your coverage will be considered effective as of Dec. 1. You may also be able to get help with. Coverage can start as soon as January 1. December Last day to enroll in or change plans for coverage to start January 1. January 1: Coverage starts for.

Thus the earliest your health insurance can possibly become effective is the beginning of the pay period that begins after the pay period in which you are hired. have health insurance in the previous tax year. Lost or will soon lose my health insurance. You lose Medi-Cal coverage. You lose your employer-sponsored. Why choose a MyPriority Short-term plan? null. Get coverage fast. You can Do I get preventive care under a short-term insurance plan? No. Preventive. How to enroll You can get a quote and enroll online. Or you can work with an agent. You'll need to provide some basic information to get a quote. Then fill. Get a car insurance quote in under 3 minutes. Learn about coverages and discounts, here. Need same day car insurance? Eligible users can get same day insurance coverage. Review our FAQs, and see how much you could save on auto insurance. Short-term plans can be purchased at any time during the year with coverage starting as soon as the next day. View Plans. A young man using his phone while. How Do I Know If I Have a Grace Period? It is always important to read your policy and find out if, and what, your grace period covers your vehicle purchase. How Long Does It Take to Get Car Insurance? If you have all of the necessary documents and information in hand about your vehicle and drivers on the policy. Having a teen driver can get expensive, quickly. Maybe one of those young drivers is your teen! Parents and guardians need to take the time to talk to teen. Then answer some questions about yourself, the car you want to insure and the people who will be driving the vehicle. You can also get fast car insurance quotes. In most cases, you should be able to drive immediately after purchasing insurance, but there are a few important considerations to keep in mind. When you buy a. A Special Enrollment Period due to a recent loss of Medicaid or Children's Health Insurance Program (CHIP) coverage. If you recently lost (or will soon lose). All PA residents who are citizens, U.S. nationals, or have a qualified immigration status can apply and enroll in health coverage through Pennie. Open. In mbdou-32-sakh.ru and some other states, if you have advance notice of your coverage loss, you can apply for the special enrollment opportunity up to 60 days in. Depending on how thoroughly you shop, getting and comparing quotes may take 15 minutes to an hour. When you make your car insurance purchase, you can usually. This site contains information about health insurance, how to get covered, and how to use your coverage to keep yourself and your family healthy. How long do I have to get insurance after I register my car? Customers have 30 days after initial registration to submit insurance. If we find you eligible within 90 days after the date you lost coverage, we will cover you for the period you were without coverage. The fastest way to renew. These time periods are called Open Enrollment and Special Enrollment. Open Enrollment Period. The annual Open Enrollment Period (OEP) is a time when you can.

Cd Rates For Large Amounts

Jumbos have a higher rate because they require a larger minimum investment than the standard CD. The amount up to which the FDIC insures CDs Because of the larger minimum investment, banks tend to offer higher rates on their jumbo CDs as compared to traditional CDs. large quantities of individual. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. A certificate of deposit (CD) allows you to earn high interest rates by agreeing to leave money in the bank for a specified amount of time. A woman sits at. You deposit a larger amount of money. You choose a specific term for a CD based on special rates offered by your financial institution. For example, BECU's. View a side-by-side comparison of our different CD options. High Yield CD. 's Best Credit Union CD Rates – Editor's Picks ; 1-year CD, Elements Financial CD, % ; 3-year CD, Farmers Insurance Group Federal Credit Union CD, %. If you're ready to put a large amount of money to work safely, a jumbo CD might help you squeeze some extra yield out of your savings. LendingClub is an online bank that offers six terms of CDs ranging from six months to five years. A $2, minimum deposit is required. In addition to CDs. Jumbos have a higher rate because they require a larger minimum investment than the standard CD. The amount up to which the FDIC insures CDs Because of the larger minimum investment, banks tend to offer higher rates on their jumbo CDs as compared to traditional CDs. large quantities of individual. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. A certificate of deposit (CD) allows you to earn high interest rates by agreeing to leave money in the bank for a specified amount of time. A woman sits at. You deposit a larger amount of money. You choose a specific term for a CD based on special rates offered by your financial institution. For example, BECU's. View a side-by-side comparison of our different CD options. High Yield CD. 's Best Credit Union CD Rates – Editor's Picks ; 1-year CD, Elements Financial CD, % ; 3-year CD, Farmers Insurance Group Federal Credit Union CD, %. If you're ready to put a large amount of money to work safely, a jumbo CD might help you squeeze some extra yield out of your savings. LendingClub is an online bank that offers six terms of CDs ranging from six months to five years. A $2, minimum deposit is required. In addition to CDs.

Advantages of Traditional and Jumbo CDs · A fixed interest rate - When you open a CD account you keep your money in an account for an agreed upon amount of time. APY ; CFG High Yield Money Market Online and In Branch*, $1,, $1,+, %, % ; 12 Month CD Online and In Branch, $, $, %, %. Personal CD Rates ; 1 year, %, % ; 15 month, %, % ; 18 month, %, % ; 2 year, %, %. Best Jumbo CD Rates ; Our Picks. Editor's Choice: Best Overall. Alliant Credit Union ; Best for Short-Term Rates. GREAT FOR: High Short-Term Offerings. Chase Bank. Best jumbo CD rates September ; My eBanc Jumbo Online Time Deposit · % to % · 6 months to 36 months ; State Bank of Texas Jumbo certificates of deposit. You don't have to deposit large amounts of money into a CD account. You can CD Rates Open a Business Certificate of Deposit. Business CD Rates. Traditional CDs allow you to invest a specific amount for a predefined term with fixed interest rates throughout the life of your CD: ; Term, Rate ; 3 Months. CIT Bank is a popular online-only bank that's best known for its high-yield savings account. However, it also offers jumbo CDs starting at % for a two-year. Earn % fixed APY on a 6-month CD or % APY on a 9-month CD. 1. No deposit maximum, low deposit minimum of $1,; Fixed Interest rate that compounds. fees or an increase in the amount of these fees. What are your current auto loan Overdraft Protection is a great way to protect against the large fees. The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the last 15 years. But as. Bankrate's picks for the top 9-month CD rates · America First Credit Union · CIBC Bank USA · Ally Bank · Synchrony Bank · Marcus by Goldman Sachs · EverBank · Sallie. Current 3-year CD rates · LendingClub Bank — % APY · SchoolsFirst Federal Credit Union — % APY · First Internet Bank of Indiana — % APY · Synchrony Bank. Automatically renews to a Fixed Term CD of the same term but at a different rate. We may limit the amount you deposit in one or more Featured CDs to a. CERTIFICATE OF DEPOSIT (CD) · Smart CD savings and a great rate? You got it. For a limited time, lock in a promotional rate of % annual percentage yield (APY). Get the benefits of jumbo CD rates without high initial investment. Open an Just because you have a large amount to invest doesn't necessarily mean. Our high yield online Certificates of Deposit guarantees a return on your savings. Access great interest rates on deposits with no monthly fees at BMO Alto. Certificate of Deposit Rates. Term, APY*. Special - 6 Months, %. amounts larger than $, Learn more. Deposit placement through CDARS or. Overview ; % Annual Percentage Yield accurate as of August 29, , 7-month Jumbo CD with Relationship Rewards up to $, · $, · Seven days to. CDs are bank deposits that pay a stated amount of interest for a specified period of time and promise to return your money on a specific date.

Best Banks For Large Accounts

The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Major national banks generally offer minuscule APYs compared to some of the top institutions on our list. For example, Bank of America, Chase Bank, and Wells. Premium Interest Checking. This account is best for earning interest on larger account balances. Earn more as your balance grows with tiered. The APY is much lower than other high-yield savings accounts—it's average at best. There's no reason to open an Axos account unless you've already maxed out the. The official site of Bank OZK. We provide our customers an array of top-rated banking solutions: online and mobile banking, checking, savings. Citizens Bank. National Bank, Low Fees ; Comerica. National Bank, Checking/savings Combo ; Digital Federal Credit Union. Credit Union, High Yield Savings Account. 1. Bank of America · 4, branches in 37 states and 15,+ ATMs · Avoid account fees with daily or monthly minimums · Why We Like It? Customers can choose from a. UFB Direct offers high-yield deposit accounts as well as home lending products. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Major national banks generally offer minuscule APYs compared to some of the top institutions on our list. For example, Bank of America, Chase Bank, and Wells. Premium Interest Checking. This account is best for earning interest on larger account balances. Earn more as your balance grows with tiered. The APY is much lower than other high-yield savings accounts—it's average at best. There's no reason to open an Axos account unless you've already maxed out the. The official site of Bank OZK. We provide our customers an array of top-rated banking solutions: online and mobile banking, checking, savings. Citizens Bank. National Bank, Low Fees ; Comerica. National Bank, Checking/savings Combo ; Digital Federal Credit Union. Credit Union, High Yield Savings Account. 1. Bank of America · 4, branches in 37 states and 15,+ ATMs · Avoid account fees with daily or monthly minimums · Why We Like It? Customers can choose from a. UFB Direct offers high-yield deposit accounts as well as home lending products.

Beyond the perks, Premier accounts are also set up to accommodate larger sums of money by offering greater ATM withdrawals and personalised “wealth managers”. Ready to take a big step toward your financial goals? A bank account can be your best ally. It keeps your money safe, gives you quick access to your funds. Bank Accounts · Credit Cards · Mortgages · Borrowing · Personal Investing · Insurance back to top Top. See you in a bit. You are now leaving our website and. The Ascent named CIT Bank Platinum Savings the Best High-Yield Savings Account, acknowledging its top-of-market APY. View Awards. The 10 Best Rich People Bank Accounts · Bank of America Private Bank · Chase Private Client · Morgan Stanley CashPlus · HSBC Premier Checking · TD Bank Private. Locally Known, Nationally Recognized. Top Public Companies in the Philadelphia Region - Philadelphia Business Journal. Award logo. First Bank is the leading independent, full-service community bank in the Carolinas. From personal to business banking, our local team is here to help you. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. Axos Bank Rewards Checking · Consumers Credit Union Rewards Checking · Presidential Bank Advantage Checking · Wealthfront Cash Account · Redneck Bank Redneck. Across Northern New England. Logo for America's Best Regional Banks We provide the technology offerings and capabilities you would expect from a larger. Depending on how much you have in investable assets, Chase Private Client and J.P. Morgan Private Bank are two of the best banks for high-net-worth. Best Savings Accounts – August · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance. UFB Direct is an online-only bank and a division of the more widely known Axos Bank, headquartered in San Diego. It offers checking, high-yield savings, money. The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. It operates completely virtually and allows customers to make deposits, process transactions, and manage their accounts with the mobile app, with cool features. With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. Nationwide banking solutions. Wells Fargo is a larger bank, with over 4, U.S. branches and over 12, ATMs. Its widespread access makes it easy to deposit. Move your money to a high-yield account with one of the best APYs in the We convey funds to partner banks who accept and maintain deposits, provide. Choose a bank account. Most popular. Overdraft fee-free. Teen and student Not sure which checking account is the best fit? Compare all checking. Explore the best banking services with IBC across Oklahoma and Texas. Flexible banking so you can do more at your convenience. Join us today!