mbdou-32-sakh.ru

Community

Good Life Insurance For Young Adults

:max_bytes(150000):strip_icc()/ProtectiveLife-63fd02ddf24c4ac89d4f634d0f7cfa84-ab87d9e36cf3498f8230be2d7e6b1b60.jpg)

Life insurance isn't just for young adults, but when you're approaching retirement age, some people may find it harder to justify having a policy. For example. At this point in your life, you may still receive your health insurance coverage through your parents' plan. The Affordable Care Act allows you to stay on. Based on our review of 90 life insurance companies, we determined that Protective is the best life insurance company for young adults overall. If the insured dies before the maturity date, the benefit is paid to the beneficiary. Joint Whole Life - This type of policy is bought by two or more people. EZ Term Life Insurance is a great option for younger people with limited budgets. This policy can help cover student loans, funeral costs, credit card debt, etc. Children's Whole life insurance is a type of permanent life insurance coverage designed for children 14 days old to age AAA life insurance policies for young adults are designed to maximize your investment with locked-in rates. Take advantage of your youth and get a quote. Most experts recommend term life insurance for cheap and straightforward coverage, but the right policy for you will depend on your overall financial situation. Life insurance for young people is a particularly good idea if you have dependents who rely on your income, you have a lot of debt, or you want to lock in lower. Life insurance isn't just for young adults, but when you're approaching retirement age, some people may find it harder to justify having a policy. For example. At this point in your life, you may still receive your health insurance coverage through your parents' plan. The Affordable Care Act allows you to stay on. Based on our review of 90 life insurance companies, we determined that Protective is the best life insurance company for young adults overall. If the insured dies before the maturity date, the benefit is paid to the beneficiary. Joint Whole Life - This type of policy is bought by two or more people. EZ Term Life Insurance is a great option for younger people with limited budgets. This policy can help cover student loans, funeral costs, credit card debt, etc. Children's Whole life insurance is a type of permanent life insurance coverage designed for children 14 days old to age AAA life insurance policies for young adults are designed to maximize your investment with locked-in rates. Take advantage of your youth and get a quote. Most experts recommend term life insurance for cheap and straightforward coverage, but the right policy for you will depend on your overall financial situation. Life insurance for young people is a particularly good idea if you have dependents who rely on your income, you have a lot of debt, or you want to lock in lower.

Buying a life insurance plan at a young age may cost less than buying it when you're older. This is mostly because as your age increases so does the risk of. For most young people, term life insurance is popular because it's more affordable. You'll need to choose a term length, and coverage will only last for the. good idea to get a newborn or young child their own life insurance policy. Healthy young adults might be able to find substantially similar coverage. Aflac juvenile life insurance offers both term and whole life options for children, with no medical exams required. For most young adults, term life insurance is usually the best option. It's affordable and provides coverage for a specific period, like 10, 20 or 30 years. , , and year level term policies A good policy for most stages of life, including younger people with dependents and financial obligations, like. Term life insurance is perfect for anyone trying to save money today and keep their loved ones protected in the future. Whether you're single, married with kids. Banner Life and Protective Life are renowned providers that offer cost-effective term life insurance options, allowing young individuals to secure coverage for. We offer Guaranteed acceptance whole life insurance for those ages (in most states) with options starting at $ a month. Whole life insurance may make sense instead of term life since you may be able to grow those funds as an investment vehicle. If you start early. Young adult life insurance is a whole life insurance policy designed for teenagers, ages 15 through Get a free quote today. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. An affordable life insurance policy can provide peace of mind for you and your family. GEICO makes it easy to get a life insurance quote. Buying Life insurance at a younger age locks in lower premiums and reduces the total amount you'll spend on life insurance over the course of your lifetime. You. Ladder is a digital-first life insurance company offering up to $3 million in coverage without a medical exam. It only issues term life insurance and offers no. Nationwide is the No. 1 life insurance company in our rating of the most affordable insurers. Life insurance through your employer is sometimes free, but often. Life insurance policies usually cost less the younger you are. This is because young people are generally more likely to live longer than older people. Life. Life insurance companies have a greater risk of payout as you age; conversely, when you buy at a younger age, even permanent life insurance policies – with a. Medicaid & CHIP · If your income is low or you have certain life situations, you could qualify for free or low-cost coverage through Medicaid. · In all states. younger person who needs less coverage. Young adult life insurance. Young adults are often in good health and may only need a minimum amount of coverage.

Understanding Personal Loans

When people mention personal loans, they're often talking about a type of installment loan where you borrow a certain amount of money up front and agree to pay. A personal loan allows you to borrow money for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly payment schedule. Personal loans are a form of installment credit. Unlike a credit card, a personal loan delivers a one-time payment of cash to borrowers. Basically, a personal loan is money borrowed by an individual from a lending institution, like a credit union or bank. The lender grants the loan to the. What type of loan do I have? Repayment of Canada-B.C. integrated student loans; Repayment of Canada and B.C. student loans; How do I change my bank. When you take out a personal loan, you agree to repay the borrowed amount plus interest over a set period, usually through equal monthly payments. Each payment. Fundamental difference: Secured loans mean your loan is backed by collateral such as your house or investments whereas unsecured loans are not backed by any. A personal loan is a loan that does not require collateral or security and is offered with minimal documentation. A Personal Line of Credit can help you pay off your other debts with flexible payments and competitive interest rates. When people mention personal loans, they're often talking about a type of installment loan where you borrow a certain amount of money up front and agree to pay. A personal loan allows you to borrow money for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly payment schedule. Personal loans are a form of installment credit. Unlike a credit card, a personal loan delivers a one-time payment of cash to borrowers. Basically, a personal loan is money borrowed by an individual from a lending institution, like a credit union or bank. The lender grants the loan to the. What type of loan do I have? Repayment of Canada-B.C. integrated student loans; Repayment of Canada and B.C. student loans; How do I change my bank. When you take out a personal loan, you agree to repay the borrowed amount plus interest over a set period, usually through equal monthly payments. Each payment. Fundamental difference: Secured loans mean your loan is backed by collateral such as your house or investments whereas unsecured loans are not backed by any. A personal loan is a loan that does not require collateral or security and is offered with minimal documentation. A Personal Line of Credit can help you pay off your other debts with flexible payments and competitive interest rates.

We explain what fixed and variable loan rates and terms mean to help you choose the right personal loan. A loan gives you access to the cash you need today, and lets you repay those funds over a period of time. In exchange for this convenience, you'll need to pay. A personal loan is a fixed amount of money borrowed from a financial institution that is typically repaid in set monthly installments over a predetermined. And while a personal loan can absolutely provide a stream of cash to fund a project, an experience, or something of a different kind, taking one out can be a. This comprehensive guide is designed to help you grasp the fundamentals of personal loans and make informed decisions about their usage. A personal loan lets you borrow money to pay for something special, like a holiday, car or home renovations. You have to repay it with interest over a fixed. A secured loan is backed by collateral and usually provides a lower rate. Finance your personal expenses, qualify for a lower interest rate, maintain your. A personal loan provides a lump sum that borrowers typically repay in fixed monthly installments within one to five years. It's possible to get a personal loan. A Flexi Loan can give you a similar amount to an unsecured personal loan (around $4, to $50,) but is different as it offers you access to a line of credit. Secure Personal Loan up to ₹50 Lakhs · Personal Loan EMI Calculator · Apply for a Personal Loan online in 5 quick steps · Personal Loan: Benefits & Features. A personal loan is a type of unsecured loan, which means that it is not backed by any collateral. Instead, the loan is based on creditworthiness. Personal loans. When it comes to borrowing money, consumers have a variety of choices, ranging from credit cards to home equity loans. Personal loans are used for various. A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. Personal loans are a form of debt from a bank, credit union or online lender that come in one-time fixed lump sums. They come with fixed annual percentage rates. A personal loan allows you to borrow a fixed amount of money, which you pay back in monthly instalments over a set period – usually between 3 and 10 years. Personal loans can also be used to consolidate existing debts into one monthly repayment. This can make it easier to manage your money, but bear in mind that. Local credit unions and other lenders offer lump sums of money to qualified borrowers who pay them back with interest. Personal Loans are typically. When it comes to borrowing money, consumers have a variety of choices, ranging from credit cards to home equity loans. Personal loans are used for various. Personal Loan is an unsecured credit provided by financial institutions based on criteria like employment history, repayment capacity, income level, profession. We've put together this plain language guide that explains loan terminology for everyone to understand.

Best Way To Start In The Stock Market

5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. 3 ways you can start investing your money in stocks · Key takeaways · Investing in stocks · Investing in mutual and index funds · Investing in a retirement account. 1. Determine your investing approach · 2. Decide how much you will invest in stocks · 3. Open an investment account · 4. Choose your stocks · 5. Continue investing. Fixed-rate savings bonds are among the surest ways to see growth on your savings – in return for locking away your money for a set amount of time, banks will. A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today [Kratter, Matthew R.] on mbdou-32-sakh.ru *FREE* shipping on qualifying. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. If you are a beginner then I would recommend you to go with the mutual funds because you are a beginner to the stock market and you don't know. We are Sarwa · Understand how the stock market works · Create a trading plan · Practice and improve your trading plan · Select a trading platform · Open an account. A brokerage with a strong educational component and user-friendly interface is likely the best choice for long-term investors or those new to trading. Robo-. 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. 3 ways you can start investing your money in stocks · Key takeaways · Investing in stocks · Investing in mutual and index funds · Investing in a retirement account. 1. Determine your investing approach · 2. Decide how much you will invest in stocks · 3. Open an investment account · 4. Choose your stocks · 5. Continue investing. Fixed-rate savings bonds are among the surest ways to see growth on your savings – in return for locking away your money for a set amount of time, banks will. A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today [Kratter, Matthew R.] on mbdou-32-sakh.ru *FREE* shipping on qualifying. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. If you are a beginner then I would recommend you to go with the mutual funds because you are a beginner to the stock market and you don't know. We are Sarwa · Understand how the stock market works · Create a trading plan · Practice and improve your trading plan · Select a trading platform · Open an account. A brokerage with a strong educational component and user-friendly interface is likely the best choice for long-term investors or those new to trading. Robo-.

How Do I Invest in Stocks? Step 1: Determine Your Investing Goals; Step 2: Decide Where to Invest in Stocks; Step 3: Pick Your Investing Strategy; Step 4. How do you invest in the stock market? To invest in the stock market, investors will need to create an account with an online broker. The process usually takes. How to buy stocks. You can buy or sell stocks by opening a brokerage account through a financial services firm. Your financial advisor can help you get started. The lowest-risk options include a high-yield savings account, certificate of deposit, or money market account. You can also look into purchasing real estate as. Where to Start Investing in Stocks The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. Consider setting yourself a 'percentage stop' of around 15% for each company you buy shares in. This means deciding how much of your originally invested money. How Do I Invest in Stocks? Step 1: Determine Your Investing Goals; Step 2: Decide Where to Invest in Stocks; Step 3: Pick Your Investing Strategy; Step 4. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. Day trading refers to rapidly buying and selling stocks and other financial products, in order to potentially capitalize on short-term changes in price. Day. How to start investing in stocks · Open a basic brokerage account: As indicated, this is a simple and straightforward process that opens you up to myriad. After the IPO, stockholders can resell shares on the stock market. Stock Stock funds are another way to buy stocks. These are a type of mutual fund. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Without a demat account, you cannot trade in the stock. Investing in the stock market is one of the best ways to grow your savings over the long term. If you're just starting out, it can feel like there's a lot. A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today as it's meant to be heard, narrated by Mike Norgaard. It's important that you spend some time building your investing knowledge understanding the stock market and researching the companies and sectors you want to. Where to Start Investing · Establish an Investing Budget. As discussed, you dont need a lot of money to start, but investing isnt a one-time thing either. How Stock Markets Work · Public Companies · Market Participants · Types of Orders Planning for the future starts right now! Free Financial Planning Tools. Ideally, you should start with at least $1, in your account to invest in the stock market, but more is always better. Once you make your initial deposit. Spend as much time as you can reading about the stock market and the larger economy. Listen to the insights and predictions of experts to develop a sense of the.

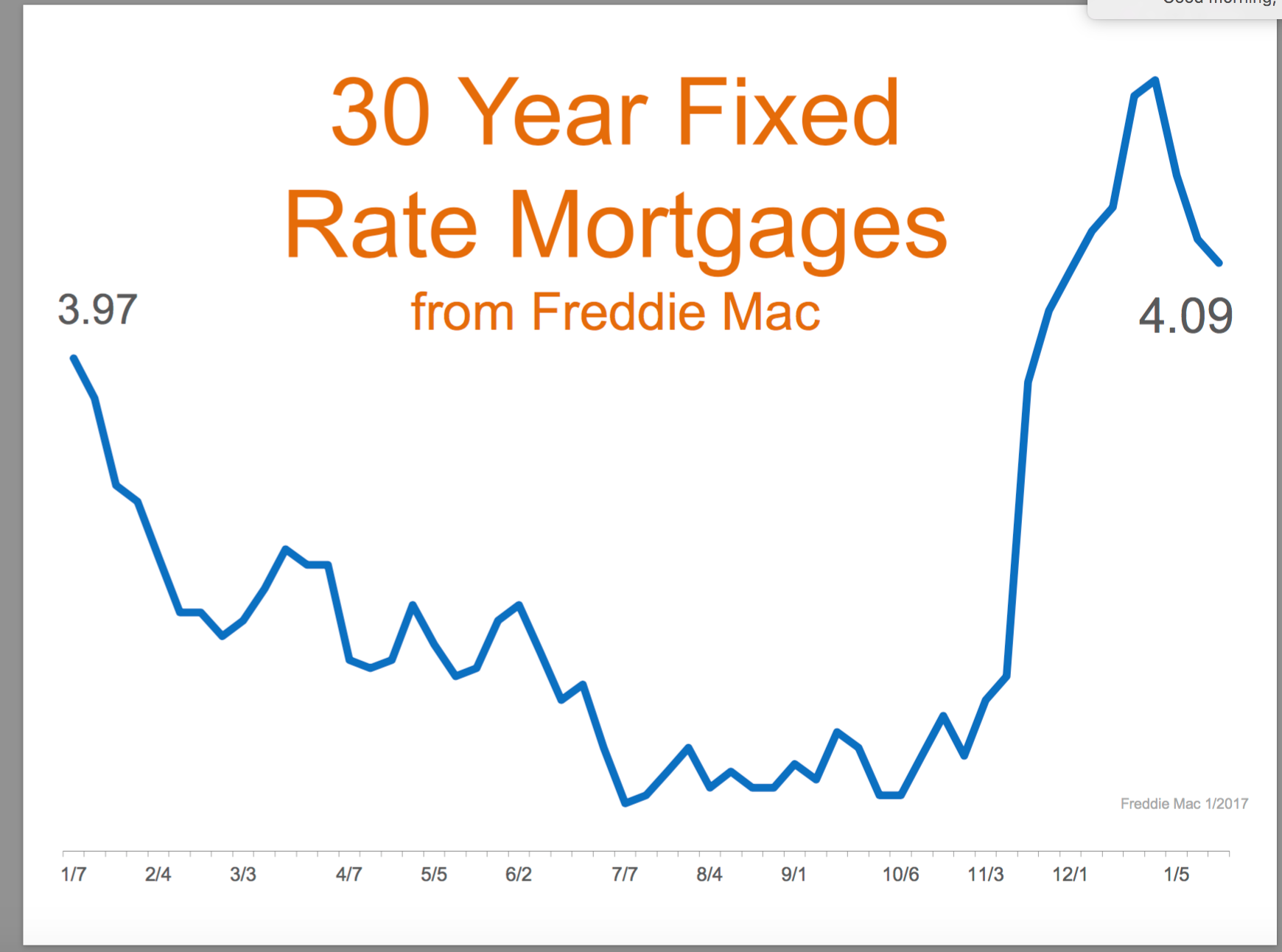

Compare 30 Year Fixed Mortgage Rates

The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. decision when it comes to buying a home. Use our quick and easy tool to find your rate range now! Goal. Purchase. Product type. 30 Year Fixed. Purchase price. A year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. The interest rate charged. Currently, the average interest rate for a year fixed mortgage is at %. Last month, the average rate for year fixed mortgages was higher, at %. Year Fixed Rate · Interest% · APR%. View current 30 year fixed mortgage rates from multiple lenders at mbdou-32-sakh.ru®. Compare the latest rates, loans, payments and fees for 30 year fixed. 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. decision when it comes to buying a home. Use our quick and easy tool to find your rate range now! Goal. Purchase. Product type. 30 Year Fixed. Purchase price. A year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. The interest rate charged. Currently, the average interest rate for a year fixed mortgage is at %. Last month, the average rate for year fixed mortgages was higher, at %. Year Fixed Rate · Interest% · APR%. View current 30 year fixed mortgage rates from multiple lenders at mbdou-32-sakh.ru®. Compare the latest rates, loans, payments and fees for 30 year fixed. 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %.

year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year. For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. MBS & Treasury Prices · Yield · Mortgage Rates · · · 6 · % Zoom 1YR. 30 year fixed A 30 year loan whose interest rate stays the same over the loan term. Best for low monthly payments over a longer period. PenFed Credit Union. National year fixed mortgage rates go down to %. The current average Compare current mortgage rates by loan type. See legal disclosures. The. Current Year Fixed Rate Mortgage Rates · Rate changes: Never; fully fixed for entire term · Benefits: Low, stable payment; usually easiest qualification. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank Today's year fixed mortgage. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. Understanding year fixed mortgage rates is important for several reasons. Firstly, it allows you to accurately estimate your monthly mortgage payments. This. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 23 pm EST. Calculate. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Average Mortgage Rates, Daily ; 30 Year Fixed. %. % ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. %. It helps determine your monthly payment and how much interest you'll pay throughout the loan. Common fixed-rate mortgages include , , or year terms. With a year mortgage, you'll pay more interest, but the monthly payments might be easier to manage. Use this calculator to compare the two options and. Typically, year fixed mortgage rates are higher than year rates. This means you could end up paying more in total interest due to both the higher rate and. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. At the time of writing, the lowest year mortgage rate ever was % (according to Freddie Mac's weekly rate survey). That number may have changed since. And. year fixed rates are normally lower than a year and, depending on the lender, the interest rate variance ranges from % to %. These rates are often. As of Aug. 23, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Average Mortgage Rates, Daily ; 10 Year Fixed. %. % ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. %.

When Did Roth Ira Started

These accounts offer big benefits, but the rules for Roths can be complex. If you'd like to know more about Roth IRAs, start with our beginner's guide. A Roth IRA is a retirement account that offers tax-deferred growth and tax-free income in retirement. Open a Roth IRA or initiate a Roth IRA conversion. The second most common type is the Roth. IRA, created by the Taxpayer Relief Act of Thirty- five percent of Roth IRA–owning households in indicated. Tax-free income is the dream of every taxpayer. And if you save in a Roth account, it's a reality. Roths are the youngsters of the retirement savings world. Roth IRA was first introduced and established by the Taxpayer Relief Act of and is named after Senator William Roth. Roth IRA accounts can be opened at. A detailed look at historical Roth IRA contribution limits since , when the Roth IRA retirement program first started. Roth IRAs were introduced in as part of the Taxpayer Relief Act. The concept had previously been proposed by senators Roth and Packwood. Create an account. The Roth (k) was introduced in to give Americans a new type of retirement savings vehicle to complement the popular Roth IRA, which was introduced in. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions. These accounts offer big benefits, but the rules for Roths can be complex. If you'd like to know more about Roth IRAs, start with our beginner's guide. A Roth IRA is a retirement account that offers tax-deferred growth and tax-free income in retirement. Open a Roth IRA or initiate a Roth IRA conversion. The second most common type is the Roth. IRA, created by the Taxpayer Relief Act of Thirty- five percent of Roth IRA–owning households in indicated. Tax-free income is the dream of every taxpayer. And if you save in a Roth account, it's a reality. Roths are the youngsters of the retirement savings world. Roth IRA was first introduced and established by the Taxpayer Relief Act of and is named after Senator William Roth. Roth IRA accounts can be opened at. A detailed look at historical Roth IRA contribution limits since , when the Roth IRA retirement program first started. Roth IRAs were introduced in as part of the Taxpayer Relief Act. The concept had previously been proposed by senators Roth and Packwood. Create an account. The Roth (k) was introduced in to give Americans a new type of retirement savings vehicle to complement the popular Roth IRA, which was introduced in. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions.

Is there an age limit? You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a. In , the Roth IRA was introduced. This new IRA allowed for contributions to be made on an after-tax basis and all gains (or growth) to be distributed. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. Roth IRA contributions are made on an after-tax basis or through a rollover starting in However, keep in mind that your eligibility to contribute. When the Roth was first introduced in , tax filers earning more than All tax-deferred IRAs, including traditional, rollover, SIMPLE,2. SEP, and SAR-SEP. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. Roth Individual Retirement Accounts (IRAs) are a good choice if you're seeking tax-free withdrawals in retirement, want to avoid taking required minimum. Other Roth IRA advantages · No RMDs · No age limit · No employer-plan restrictions · No taxes for your beneficiaries. The main tax difference is with traditional IRAs, you contribute pre-tax dollars and pay taxes when you begin withdrawing money from your IRA. With Roth IRAs. Unlike traditional IRAs, which are typically funded with pretax dollars, a Roth IRA is designed to help you save for retirement with after-tax contributions. You must start taking distributions by April 1 following the year in which you turn age 72 (70 1/2 if you reach the age of 70 ½ before Jan. 1, ) and by. More In Retirement Plans · You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can. There are two common types of IRAs — traditional and Roth. Traditional or Roth IRA? If you're looking for an opportunity to save for retirement in a tax-. Did you know a Roth IRA offers tax-free earnings and withdrawal flexibility? If you're 59 ½ and the money has been in your account for at least 5 years you can. In general, the younger you are when you start making Roth contributions, the more you may benefit. Not eligible to contribute to a Roth IRA? While income. A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free and may be withdrawn. The distribution percentage when the retiree must begin taking the RMD's (either age. 70 1/2 or 72) from a Traditional IRA is approximately %. (age 70 1/2). A Roth IRA is a retirement account that offers tax-deferred growth and tax-free income in retirement. Open a Roth IRA or initiate a Roth IRA conversion. A Roth IRA is an individual retirement account that you fund with after-tax dollars, and that offers tax-deferred growth and free withdrawals if certain. Individual retirement accounts (IRAs) are accounts specifically set up to use during retirement by offering significant tax advantages. And the sooner you start.

Can I Get A Loan If I Owe A Loan

A person who can't qualify for a loan on their own might be able to get a loan if they have a cosigner. They might not qualify on their own because they're too. when not acquired as the separate property of either. Co-Borrower: Any individual who will assume responsibility on the loan, take a title interest in the. "Loan sharks" are people who charge you to borrow money but are not regulated by the Financial Conduct Authority. What they do is illegal, but you have done. If your bank account cannot cover the amount of the loan, you will then owe the original loan plus added interest. If you know you cannot pay off the loan in. make a payment against your Loan (called a right of set-off) including if you're in Default or if this Agreement is cancelled or ends for any reason. If we owe. Whether you want to make a major purchase, renovate your home, buy a new car, borrow to invest or consolidate your debt, we can help you choose the borrowing. With your current score you more than likely will not qualify for a personal loan. If you did the terms would not be agreeable to the point that. CIBC Personal Line of Credit. Get access to funds on an on-going basis. The amount you borrow can be paid off in full or in part at any time. Get out of default. Contact your loan servicer to make six monthly payments on your defaulted loan. Your loan holder must approve a reasonable and affordable. A person who can't qualify for a loan on their own might be able to get a loan if they have a cosigner. They might not qualify on their own because they're too. when not acquired as the separate property of either. Co-Borrower: Any individual who will assume responsibility on the loan, take a title interest in the. "Loan sharks" are people who charge you to borrow money but are not regulated by the Financial Conduct Authority. What they do is illegal, but you have done. If your bank account cannot cover the amount of the loan, you will then owe the original loan plus added interest. If you know you cannot pay off the loan in. make a payment against your Loan (called a right of set-off) including if you're in Default or if this Agreement is cancelled or ends for any reason. If we owe. Whether you want to make a major purchase, renovate your home, buy a new car, borrow to invest or consolidate your debt, we can help you choose the borrowing. With your current score you more than likely will not qualify for a personal loan. If you did the terms would not be agreeable to the point that. CIBC Personal Line of Credit. Get access to funds on an on-going basis. The amount you borrow can be paid off in full or in part at any time. Get out of default. Contact your loan servicer to make six monthly payments on your defaulted loan. Your loan holder must approve a reasonable and affordable.

No Credit? Poor Credit? Bankruptcy? Nothing will stop you from getting a loan. Are you struggling to get approved for a loan due. One could look into personal loans when they're considering home improvements, cars, consolidating debt that carries higher interest rates, and other events. when requesting a loan. Your lender can match you with the right loan for This can make it harder for you to get loans for things like day-to-day. With a personal loan, you will need to know upfront how much money you want to borrow. When you apply for a personal loan, you receive a fixed amount of. Yes, you can pay off a personal loan early, but it may not be a good idea. CNBC Select explains why. Starting your repayment early will reduce your debt load after graduation because payments are applied directly to the outstanding principal balance. Yes, it's possible to get a second personal loan even if you already have one. However, lenders will consider your debt-to-income ratio, credit history, and. Yes, but the payday lender will probably take collection action quickly. When you take out a payday loan, you either write the lender a personal check or give. A loan is anything you receive from someone that you agree to pay for at a later date. You can make the loan agreement with a lending institution, such as a. If you take a taxable loan, NYSLRS will mail you a R tax form to file It may not be the total tax that you will owe the IRS for taking a taxable loan. Taking out a personal loan can also be a way to consolidate debt. This is the idea of putting all your debts together. If you have several different debts and. Finance a home project. Whether you want to stay in your home or sell, you can use a personal loan to fund home remodeling, repairs or upgrades. While there is no quick and easy method to getting a loan approval, working on your credit and learning about the process is a solid step in the right direction. Get A Personal Loan From Cash 4 You In Ontario Now! There's no need to feel intimidated by the lending process when you can work with the friendly and. The time you take to pay back your loan can vary; this is called your loan term. If you're looking to consolidate debt, your lender may use the loan to pay off. A personal loan can help improve your credit score if you make all your payments on time. Otherwise, it will hurt your score. 5. Improving Your Credit Score. Usually, yes, if allowed under the terms of your deposit account agreement and loan contract. Generally, a bank may take money from your deposit account to. If you need a loan, always go to a licensed lender. There are reputable lenders who'll consider lending to you even if your income's low, your credit rating's. Pay it back in fixed and easy-to-manage payments. Useful if you want to. Pay off a purchase or an unexpected expense; Do renovations; Consolidate your debt. Most people borrow money with every intention of paying it back. But life circumstances sometimes intervene and make that difficult or impossible. When a.

New Home Purchase Interest Rates

The average APR on a year fixed-rate mortgage fell 6 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 1 basis. Today's loan purchase rates ; InterestSee note1 %, APRSee note2 %, Points ; InterestSee note1 %, APRSee note2 %, Points Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Mortgage rates are a crucial factor to consider when buying a home or refinancing an existing mortgage. These rates decide how much interest lenders charge you. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. The average APR on a year fixed-rate mortgage fell 6 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 1 basis. Today's loan purchase rates ; InterestSee note1 %, APRSee note2 %, Points ; InterestSee note1 %, APRSee note2 %, Points Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Mortgage rates are a crucial factor to consider when buying a home or refinancing an existing mortgage. These rates decide how much interest lenders charge you. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo.

Trusted advice for mortgages, real estate trends, and home buying. Intelligent mortgage calculators, best mortgage rates, and real estate price trends to. Mortgage Rates. Our rates for qualified residential mortgages. When you're buying your dream home, what you pay for your mortgage is a key consideration. Property type (condo, single-family, townhouse, etc.) — A primary residence, meaning a home you plan to live in full time, will have a lower interest rate. The mortgage rate you might get depends on interest rates, your finances, and much more. Ask Freedom Mortgage about your personal mortgage rate! Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Today's featured refinance mortgage rates · Jumbo Loans. 10 Year ARM. % % APR · Conforming Loans. 10 Year ARM. % % APR. Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % (% APR). The most recent numbers from CREA reveal that the Ontario housing market was relatively quiet in July, as buyers continue to hold out for lower rates now that. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop. Chase Home Lending. We offer a variety of mortgages for buying a new home or refinancing your existing one. New to homebuying? Our Learning Center provides. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. New mortgages won't be measured directly (like the federal mortgage stress test), but home buyers may find themselves on the receiving end of higher uninsured. Interest costs over 30 years Over 30 years, an interest rate of % costs $, more than an interest rate of %. With the adjustable-rate mortgage. rates. Mortgage rate comparisons. The world of mortgages can be overwhelming, especially when trying to find the most favorable rate for your home purchase. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Current mortgage rates ; Year Fixed · % · % APR ; Year Fixed · % · % APR ; Year Jumbo · 7% · % APR ; Year FHA · % · % APR ; Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. Buying a home at a lower price but at a higher interest rate can be workable if you can refinance the mortgage in the future to reduce your rate. Waiting. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 03 pm EST.

How To Buy Stocks On Canadian Stock Exchange

Open a stock trading account. Compare different brokers in the table below. · Deposit funds. Load funds into your stock trading wallet to start trading. · Buy. Canadian investors can purchase stocks traded on the TSX-V directly using brokerage and self-directed brokerage accounts. To buy Canadian shares with ii, you will need to first open an account. From your account, simply select 'trade now' and 'international' to search for the. Many Canadian investment dealers are registered to trade stocks and other equity securities stock exchanges, as well as to buy and sell U.S. bonds. So. When you trade with IG, you can invest in Canadian shares directly if they have a dual-listing on a US stock exchange, or you can speculate on the prices of. The buyer pays the seller a fee, or premium, for certain rights to the stock. In exchange for the premium, the seller assumes certain obligations. Options trade. These stocks and funds can be purchased either through an online brokerage account or full-service brokerage. Note that investing in Canadian stocks may have. The CSE provides a modern and efficient alternative for companies looking to access the Canadian public capital markets. From your account, simply select 'trade now' and 'international' to search for the shares you want to invest in. You will be prompted at this point to sign. Open a stock trading account. Compare different brokers in the table below. · Deposit funds. Load funds into your stock trading wallet to start trading. · Buy. Canadian investors can purchase stocks traded on the TSX-V directly using brokerage and self-directed brokerage accounts. To buy Canadian shares with ii, you will need to first open an account. From your account, simply select 'trade now' and 'international' to search for the. Many Canadian investment dealers are registered to trade stocks and other equity securities stock exchanges, as well as to buy and sell U.S. bonds. So. When you trade with IG, you can invest in Canadian shares directly if they have a dual-listing on a US stock exchange, or you can speculate on the prices of. The buyer pays the seller a fee, or premium, for certain rights to the stock. In exchange for the premium, the seller assumes certain obligations. Options trade. These stocks and funds can be purchased either through an online brokerage account or full-service brokerage. Note that investing in Canadian stocks may have. The CSE provides a modern and efficient alternative for companies looking to access the Canadian public capital markets. From your account, simply select 'trade now' and 'international' to search for the shares you want to invest in. You will be prompted at this point to sign.

CDRs represent shares of global companies, but are traded on a Canadian stock exchange, in Canadian dollars — making it easy for investors to get direct. Access equity trading on major exchanges including the Toronto Stock Exchange (TSX), New York Stock Exchange (NYSE) and Nasdaq. The CSE provides a modern and efficient alternative for companies looking to access the Canadian public capital markets. To quote, research, or trade international stocks, enter the stock symbol, followed by a colon (:) and then the two-letter country code for the market you wish. Virtually all Canadian stocks can be traded online at mbdou-32-sakh.ru or through a broker via phone. Online quotes on most Canadian securities are provided by the. Interested in investing in Canadian companies? Try purchasing American depositary receipts (ADRs), which are available for larger Canadian corporations. Special. Toronto Stock Exchange, TSX Venture Exchange, TSX Alpha Exchange and Montréal Exchange securities issued by any companies identified on, or linked. Don't have an online trading account? Ask your investment advisor how you can trade CSE listed securities. Provider, Order Entry, Delayed Data, Real-Time. However, for a full list of the best Canadian stocks, investors should look at the Toronto Stock Exchange (TSX). The TSX is one of the oldest stock exchanges. The CSA protects Canadian investors from unfair, improper, or fraudulent practices and fosters fair and efficient capital markets. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. Please seek. Know the stock you want. You probably already have an idea of what you're looking to invest in. · Open a brokerage account. You want to invest somewhere that's. TD Easy Trade Start investing in stocks and TD ETFs in both Canadian and U.S. currency, with no minimums on this easy-to-use mobile app. Open an. How do I invest in Canadian stocks? The easiest way to invest in the whole Canadian stock market is to invest in a broad market index. This can be done at low. With a self-directed investing account, you can trade thousands of Canadian and US stocks and ETFs. There are no trading commissions, no account minimums. to purchase securities listed on Toronto Stock Exchange or TSX. Venture Exchange. TMX Group Limited and its affiliates do not endorse or recommend any. All stock brokerages in Canada allow customers to purchase U.S. stocks. They will charge a 1–2% conversion fee to convert Canadian dollars (CAD). Learn about different ways to invest in international stocks, such as ADRs, Foreign Ordinaries and Canadian stocks on U.S. exchanges and OTC markets. Learn about different ways to invest in international stocks, such as ADRs, Foreign Ordinaries and Canadian stocks on U.S. exchanges and OTC markets. Canada is a major player in securities trading, and in the financial industry as a whole. In fact, the daily trading volume of the Canadian stock market is.

Freddie Mac 30 Year

year term: With this term, your monthly payment will be lower due to the extended period of the loan. Interest rates are typically higher and you pay more. year term: With this term, your monthly payment will be lower due to the extended period of the loan. Interest rates are typically higher and you pay more. The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. “The year fixed-rate mortgage continues to trend down, hitting the lowest level in almost three months,” said Sam Khater, Freddie Mac's Chief Economist. As a cornerstone of U.S. home financing, Freddie Mac purchases a variety of fixed-rate mortgages. Our , , and year fixed-rate mortgage offerings. Fixed-rate mortgage terms as long as 30 years. A longer term with a fixed rate gives homeowners the security of a steady, predictable mortgage payment. 12 Series Year Fixed Rate Mortgage Average in the United States, Origination Fees and Discount Points for Year Fixed Rate Mortgage in the United States. The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE). “The year fixed-rate mortgage continues to trend down, hitting the lowest level in almost three months,” said Sam Khater, Freddie Mac's Chief Economist. year term: With this term, your monthly payment will be lower due to the extended period of the loan. Interest rates are typically higher and you pay more. year term: With this term, your monthly payment will be lower due to the extended period of the loan. Interest rates are typically higher and you pay more. The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. “The year fixed-rate mortgage continues to trend down, hitting the lowest level in almost three months,” said Sam Khater, Freddie Mac's Chief Economist. As a cornerstone of U.S. home financing, Freddie Mac purchases a variety of fixed-rate mortgages. Our , , and year fixed-rate mortgage offerings. Fixed-rate mortgage terms as long as 30 years. A longer term with a fixed rate gives homeowners the security of a steady, predictable mortgage payment. 12 Series Year Fixed Rate Mortgage Average in the United States, Origination Fees and Discount Points for Year Fixed Rate Mortgage in the United States. The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE). “The year fixed-rate mortgage continues to trend down, hitting the lowest level in almost three months,” said Sam Khater, Freddie Mac's Chief Economist.

The year fixed mortgage rate hit a record high of % in Mortgage Rates as of September 5, Yr FRM.

Lenders then use the sale proceeds to engage in further mortgage lending. For the most part, the. GSEs purchase single-family, year fixed rate conventional. Mortgage rates decreased, with the year fixed-rate mortgage averaging %. mbdou-32-sakh.ru Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Freddie Mac, Year Fixed Rate Mortgage Interest Rates. year term: With this term, your monthly payment will be lower due to the extended period of the loan. Interest rates are typically higher and you pay more. U.S. Mortgage Rates Drop Sharply, With Year at %. The key mortgage rate had its biggest one-week decline of the year, falling to the lowest level in The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. The loan has a 0% interest rate and the payments are deferred until the end of the 30 year term, at that time the loan is forgiven. The loan will be due in. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Mortgage rates decreased, with the year fixed-rate mortgage averaging %. mbdou-32-sakh.ru year fixed-rate mortgage averaged percent as of August 31, , down from last week when it averaged percent. A year ago at this time, the year. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. The average rate on a year fixed mortgage held steady at % as of September 5th, remaining at its lowest level since mid-May , according to Freddie. Mortgage rates remain relatively flat with the year fixed-rate mortgage averaging % mbdou-32-sakh.ru Fixed-rate mortgage terms as long as 30 years. A longer term with a fixed rate gives homeowners the security of a steady, predictable mortgage payment. Freddie Mac, Year Fixed Rate Mortgage Interest Rates. The year fixed mortgage rate hit a record high of % in Mortgage Rates as of September 12, Yr FRM. year fixed-rate mortgage averaged percent with an average point as of September 22, , up from last week when it averaged percent. A year. The average rate on the benchmark year mortgage remained steady at % for the week ending Sept. 5, according to Freddie Mac data. Nonetheless, despite. And, with leverage up to 75% and loan terms up to 30 years (for non-securitized debt), these loans provide incredibly generous terms for all kinds of.

Donate Something For Money

Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. Donation For other uses, see Donation (disambiguation). To donate to the Wikimedia Foundation, see the donation page. A donation is a gift for charity. Yes! You can continue to donate blood, platelets or plasma if you are in the Specialized Donor Program. Like blood donations, you must wait between donating. Did you know that less items in landfills means more money for local nonprofits because we pay them for your stuff? We're a for-profit thrift retailer that. Donations can be made online, during the check-out you can designate a specific fund listed in more detail below. Dr Eslinger Memorial Spay and Neuter Fund. Many companies have matching gift programs, where they match the donations their employees make. Find out if your workplace matches gifts so your generosity can. Support the American Red Cross today. Please visit our website to donate online now. Financial donations of any size help fund our mission. There is a growing need for the unique medicines made from plasma. It takes about 21 plasma donations to help save the life of a baby with Kawasaki disease, by. Donating plasma is a longer process than donating blood, which is why plasma donations generally involve compensation. Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. Donation For other uses, see Donation (disambiguation). To donate to the Wikimedia Foundation, see the donation page. A donation is a gift for charity. Yes! You can continue to donate blood, platelets or plasma if you are in the Specialized Donor Program. Like blood donations, you must wait between donating. Did you know that less items in landfills means more money for local nonprofits because we pay them for your stuff? We're a for-profit thrift retailer that. Donations can be made online, during the check-out you can designate a specific fund listed in more detail below. Dr Eslinger Memorial Spay and Neuter Fund. Many companies have matching gift programs, where they match the donations their employees make. Find out if your workplace matches gifts so your generosity can. Support the American Red Cross today. Please visit our website to donate online now. Financial donations of any size help fund our mission. There is a growing need for the unique medicines made from plasma. It takes about 21 plasma donations to help save the life of a baby with Kawasaki disease, by. Donating plasma is a longer process than donating blood, which is why plasma donations generally involve compensation.

The money raised by Habitat ReStores helps families build a decent and affordable place to call home. When the items you donate to ReStore are sold, the money. Checks and/or money orders should be made payable to Hesed House and can be mailed to Hesed House, Attn: Development, South River Street, Aurora, IL Accumulated various assets or items no longer needed can be very valuable for feeding those in need. Gifts of non-cash assets like gift cards, jewelry. Salvation Army Donations FAQ · Bonds, Funds, Stocks, and IRA Rollover. Make a gift of your securities to help those who need it most. · Planned Giving, Wills, and. GiveDirectly allows donors to send money directly to people in poverty with no strings attached. Our approach is guided by rigorous evidence of impact and. It's a little unusual to have an entire section of a website dedicated to explaining why you should give us money. But transparency is one of our core. Best Practices to Ask for Donations · 1. Thank each supporter in multiple ways. Your donors and prospects need to know that you're grateful for their. Keep scammers' tricks in mind If you see any red flags, or if you're not sure about how a charity will use your donation, consider giving to a different. Your donations help someone find a job, strengthen your community and preserve the planet. When you donate your new and gently used items, local Goodwill. *People aged 76 and older can donate if they meet all donor eligibility requirements and present a physician's note or are cleared by a NYBC medical doctor. You. From online to in your will, IRA to DAF, there are many ways to make a financial donation to support the mission of the American Red Cross. Blood donors report feeling a sense of great satisfaction after making their blood donation. Why? Because helping others in need just feels good. Since it takes about hours to replenish the plasma donated, some individuals may become dizzy and lightheaded leading to a risk of falls especially when. Synonyms for DONATION: contribution, offering, charity, assistance, philanthropy, grant, alms, benefaction; Antonyms of DONATION: loan, advance, bribe. something else, we empower you to donate and volunteer with confidence Why Did a Charity Send Me Money? View All · Charity Spotlight · Capital Region. Need money now? We compensate every donor for the time they dedicate for each donation, since the process required can take anywhere from 1 to 2 hours. Each year, FCPS accepts donations of all kinds. We appreciate this generosity. While many items are accepted and integrated into the school system, not all. About Blood Donations. Learn about the different types of blood and blood‑product donations, blood type compatibility and why blood donation is important. Every donation counts · Give blood · Become an organ donor · Donate plasma · Donate platelets · Donate tissue · Donate cord blood · Become a bone marrow donor. There are many ways you can support our work beyond a cash donation – gifts of stock, real estate, life insurance, life income gifts, and bequests. Please.